- Author: Robert Rushford, Release My Super 1300 941 037

Hardship claims due to Coronavirus will allow access to $10,000 superannuation payment this financial year 2020, and another $10,000 after 1 July 2020. The payments will be available from about mid-April 2020 by applying online via myGov [or via the ATO for a payment from an SMSF].

When can I access the $10,000 Coronavirus Payment?

Payments are expected from mid-April 2020 and you should apply via ATO online services, myGov.

- You must: Certify that you meet the criteria (see below) and after the ATO has processed your application, they will issue you with a determination.

- This determination will also be given to your superannuation fund, which will allow them to release your superannuation payment.

- Your fund will make the payment to you, without you needing to apply to them separately.

NB Ensure your super fund has your most up to date contact details

Coronavirus $10,000 Superannuation Payment

Those affected by the Coronavirus will gain access to their superannuation, with a $10,000 payment allowed this financial year and another $10,000 next financial year.

These payments will be tax-free and available to people eligible for the Coronavirus Supplement, sole traders who have seen a reduction in their work hours, or income falls greater than 20 per cent or more as a result of Coronavirus.

If you are a sole trader or a casual worker and you have seen your income or hours work fall by 20 per cent or more as a result of the Coronavirus, you will get access to the $10,000 Coronavirus superannuation payment.

Applications will be made online through a simple declaration to the Australian Taxation Office.

How to apply for the $10,000 Coronavirus Superannuation Payment

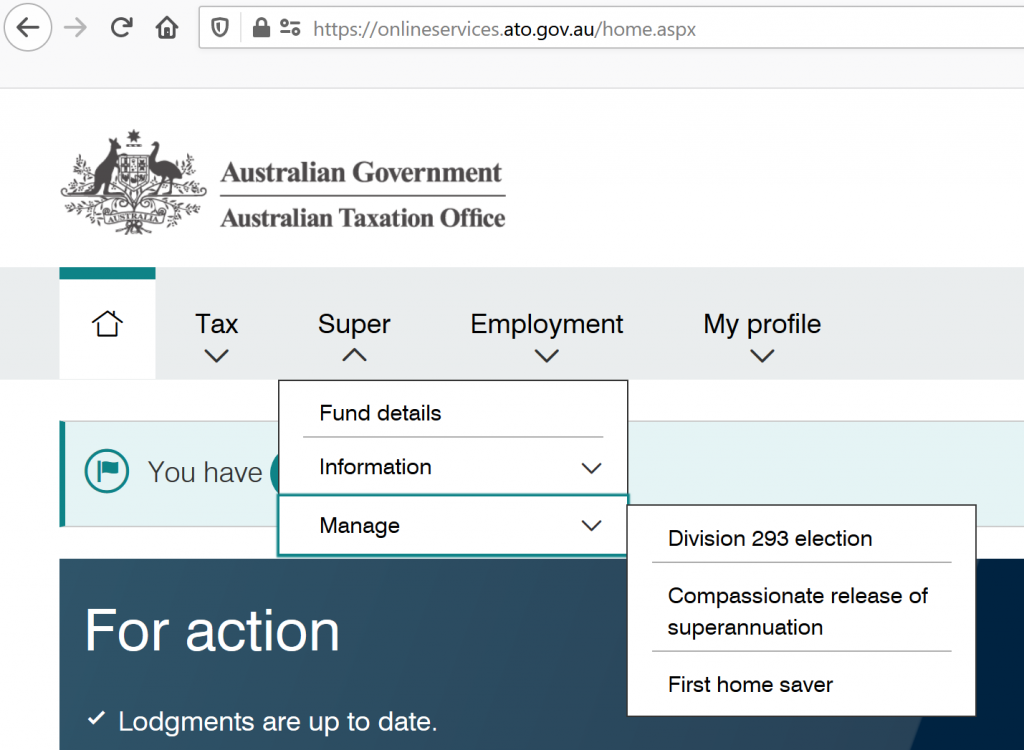

If you are eligible for the Coronavirus Superannuation Payment you can apply directly to the ATO through the myGov website: www.my.gov.au

After the ATO has processed your application, they will issue you with a determination. The ATO will also provide a copy of this determination to your superannuation fund, which will advise them to release your superannuation payment. Your fund will then make the payment to you, without you needing to apply to them directly.

However, to ensure you receive your payment as soon as possible, you should contact your fund to check that they have your correct details, including your current bank account details and proof of identity documents.

Eligibility

To apply for early release, you must satisfy the following requirements:

- you are unemployed, or you are eligible to receive a job seeker payment, youth allowance for job-seekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or on or after 1 January 2020:

- you were made redundant, or your working hours were reduced by 20 percent or more, or if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 percent or more.

People accessing their superannuation will not pay tax on amounts released and the money is withdrawn will not affect Centrelink payments.

Coronavirus Supplement

The Government also announced it will provide a temporary Coronavirus Supplement of $550 a fortnight to new and existing income support recipients for six months. People will receive their usual payment plus $550 each fortnight for the six-month period.

The Coronavirus Supplement will be provided to people receiving:

- JobSeeker Payment; Sickness Allowance; Youth Allowance for jobseekers; Parenting Payment Partnered; Parenting Payment Single

- Partner Allowance; Sickness Allowance Farm Household Allowance.

Eligibility for JobSeeker Payment and Youth Allowance for jobseekers will also be expanded to assist:

- Sole traders and self-employed will be able to meet obligation requirements by continuing to operate their businesses.

- People caring for someone infected or in isolation as a result of contact with Coronvirus.

The Government will temporarily waive, for certain payments:

- the assets test: the Ordinary Waiting Period (already waived until 12 June 2020); the Liquid Assets Waiting Period; the Seasonal Workers Preclusion Period; the Newly Arrived Residents Waiting Period.

Also access to payments will become easier with a temporary removal of the requirement for an Employment Separation Certificate, proof of rental arrangements and verification of relationship status.

Temporary early access to superannuation

Summary: The Government is allowing those affected by the Coronavirus to access up to $10,000 of superannuation in 2019-20 and a further $10,000 in 2020-21.

Eligible individuals will be able to apply online through myGov to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months.

$10,000 Temporary Early Release from SMSFs

Separate arrangements will apply if you are a member of a self-managed superannuation fund (SMSF).

How Release My Super can help you access the early release of super?

Once the guidance is available from the ATO, we can assist you to apply for the early release $10,000 Coronavirus Superannuation Payment.

If you have any questions, please contact Release My Super 1300 941 037.

Robert Rushford, Release My Super.